What is life insurance? You may safeguard your loved ones with life insurance, even after you die away. You will be leaving your family with a tax-free death benefit or payout, rather than current debt, burial fees, and other ongoing expenses. This may offer stability and financial security. You may plan for the best but be ready for the worst when you have a life insurance policy.

Do I need life insurance?

Almost everyone can gain from providing their loved ones with some degree of life insurance protection. Life insurance can assist if you have loved ones you wish to safeguard in the event of your death, regardless of whether you are starting off, raising a family, or getting ready for your golden years. Finding a policy that works for you is crucial. We provide a policy to suit your needs, whether you’re searching for extensive coverage or simply the essentials.

Life insurance can help your loved ones:

- Cover the rising cost of funeral expenses

- Replace lost wages or the value of your time (e.g., stay-at-home spouse)

- Pay off debt

- Provide for a college education

- Leave an inheritance

How much coverage do I need?

Compiling the total amount of debt your surviving loved ones would have to repay is a smart place to start when figuring out how much coverage you need. This could include burial costs, child care costs, mortgage payments, college costs, unpaid debts, and other regular obligations. The things you know you will be paying for in the future or that you already pay for should be included in your coverage amounts.

Insufficient coverage could result in significant, unforeseen financial obligations for your family. To be sure they’re covered, you may get an estimate with the aid of our coverage calculator.

What types of life insurance are there?

Term and permanent insurance are the two main types of life insurance. Term refers to a specific duration, while permanent refers to an individual’s lifetime.

| Category | Term life | Permanent life |

| Cost | As low as $10/mo | Price varies |

| Coverage term | 10-40 years | Your entire life |

| In-person medical exam | Sometimes required | Sometimes required |

| Other benefits that may be available | Conversion to a permanent policyCoverage for childrenAccidental death benefit | Cash value with tax-deferred growthAbility to take out loans or withdrawals on policy valueAccidental death benefitOptional add-ons for long term care coverage (not Accidental death benefit) |

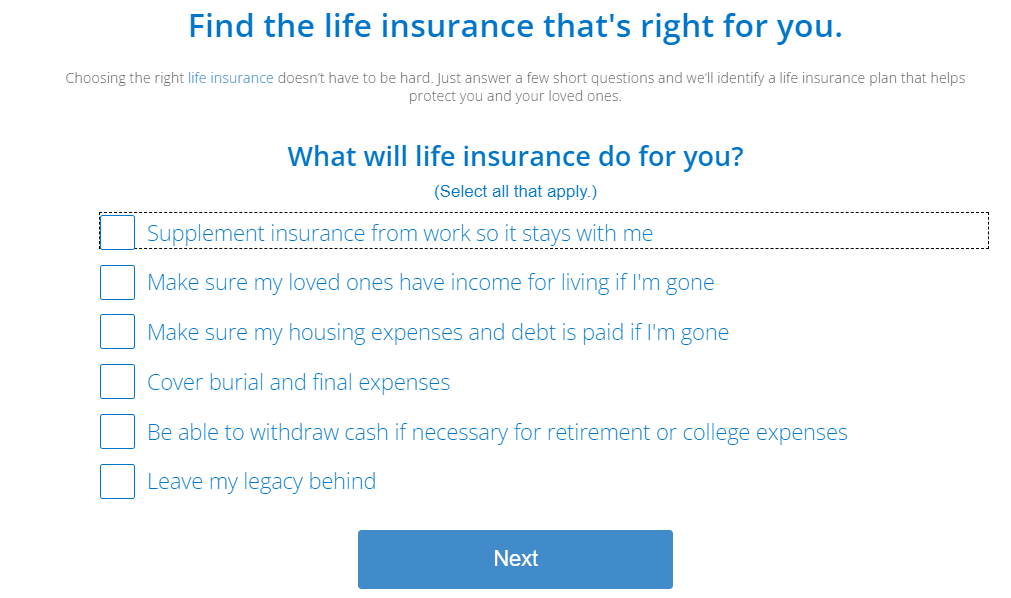

Which life insurance policy is right for me?

The type of life insurance that best suits your needs will depend on your goals. Considering your financial situation and personal objectives, our LifeTrek tool can assist you in determining the amount of life insurance coverage you require. Simply respond to a few inquiries.

Why choose term life insurance?

Anyone looking to safeguard their loved ones in the future and save money now should consider term life insurance. Anybody who might be left with a financial burden is protected by an active term life insurance policy, regardless of whether they are single, married with children, close to retirement, or anywhere in between. Additionally, the cost is far lower than that of permanent life insurance.

Life insurance calculator

Choose “get started” and start inputting the value in each field to receive an estimate of the potential amount of life insurance you require. A quick summary of some of the fields you’ll need to fill out is provided below.

Income replacement

Your annual income before taxes is referred to as your “net annual income.” The next query will concern the amount of money, as specified by your insurance policy, that your family would get in the event that you passed away. It specifically wants to know how many years your insurance policy’s death benefit would cover your present income. This is significant because it influences the length of time your family will have financial security following your death.

Mortgage balance

Choose “get started” and start inputting the value in each field to receive an estimate of the potential amount of life insurance you require. A quick summary of some of the fields you’ll need to fill out is provided below. replacement of income Your annual income before taxes is referred to as your “net annual income.” The next query will concern the amount of money, as specified by your insurance policy, that your family would get in the event that you passed away. It specifically wants to know how many years your insurance policy’s death benefit would cover your present income. This is significant because it influences the length of time your family will have financial security following your death you can to get the best estimate possible.

All outstanding debts following your death, including medical bills and funeral costs (i.e., burial plot, coffin, ceremony), are included in your final expenses. Remember that this is just a guess. As a point of comparison, the National Funeral Directors Association (NFDA) reports that the median cost of a funeral with viewing and burial was $7,848, as of 2021. These expenses do increase yearly and can differ significantly based on your location and personal preferences.

Education expenses

This is where you will enter the costs associated with your child’s education, which could include lunch or meal plans, tutoring, field excursions, books and supplies, tuition for college or private school, and more. Recall that these expenses can differ significantly based on the school, the area, and the particular requirements of your child.

Your assets

Your total amount of money and valuables that can be easily converted into cash is referred to as your “available assets.” This facilitates a better understanding of your financial status by your insurance.

Among the available assets are:

- Money you have in your bank accounts.

- Investments like stocks or bonds that can be changed into cash.

- Valuables like jewelry or valuable collections.

- The value of things like your house or car.

- Group life insurance through work

All of this influences the amount of life insurance you would require to safeguard your loved ones in the event of your death. If you have life insurance via your employment, be aware that it frequently isn’t sufficient to meet your needs and doesn’t follow you about if you move jobs. In order to receive a life insurance policy that is customized for you, it is crucial that you answer these questions truthfully.

Top five Insurance company of USA are:

Top five Insurance company of India are:

LIC

Max Life Insurance Company

HDFC Life Insurance Company

ICICI Prudential Life Insurance Company

Kotak Mahindra Life Insurance Company